The Chamber for Local Governance (ChaLoG) has asked Parliament not to approve a proposal by the government in the 2022 budget statement presented

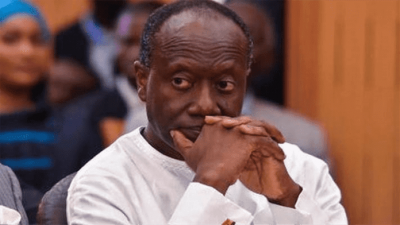

The Chamber for Local Governance (ChaLoG) has asked Parliament not to approve a proposal by the government in the 2022 budget statement presented by Finance Minister Ken Ofori Atta to control the collection of property rates taxes

ChaLog said the proposal is not only defeatist of the Fiscal Decentralization Concept, but will affect negatively the Metropolitan/Municipal/District Assemblies (MMDAs) as they will be deprived of their major source Internally Generated Funds (IGF).

A statement signed by its President Dr. Richard Fiadomor said “The Chamber for Local Governance (ChaLoG) has noted with shock and disdain the desperate attempt by the central government to deprive the Metropolitan/Municipal/District Assemblies (MMDAs) of the collection of Property Rate Taxes, which constitutes a major source of Internally Generated Funds (IGF) for the Assemblies.

“ChaLoG wishes to emphatically state that, the proposal by government as captured in the Budget Statement and Economic Policy for the 2022 Financial Year presented to Parliament, is not only defeatist of the Fiscal Decentralization Concept, but will undoubtedly affect negatively the MMDAs as they will be deprived of their major source IGF.

“As if that is not enough, the MMDAs will not be able to readily access these monies in a timeous manner should government be allowed to take over the collection of the Property Rate Taxes.

“ChaLoG notes with grave concern the poor manner the government has handled the release of the District Assembly Common Fund (DACF) since its assumption of power in January, 2017 and hence cannot be trusted to go ahead to collect the Property Rates Taxes for and on behalf of the MMDAs to be paid into the Consolidated Fund and later transferred to them.

“ChaLoG wishes to challenge the government, if it is convinced beyond reasonable doubts that the MMDAs have not been efficient in collecting the Property Rates Taxes in the past, for which reason it wants to take over the collection, to rather consider as matter urgency the following measures to empower the MMDAs to continue doing the collection:Build the capacity and retool the Revenue Departments of the MMDAs to effectively collect the Property Rates and retain a certain percentage for central government.

“Recruit and strengthened the Legal Departments of MMDAs as well as dedicate Courts to specifically deal with Revenue related issues in an expeditious manner.

“Amend the laws that exempt certain properties like churches, mosques, and government buildings from paying Property Rate Tax. Eliminate the unnecessary political interference in the collection of Property Rate Taxes from highly placed and influential people as well as politically exposed persons.”

It added “ChaLoG firmly believes if government could consider the aforementioned suggestions and adequately confront them head on, then the MMDAs would be adequately empowered to effectively and efficiently collect the Property Rate Taxes. If this is done, government would not need to get directly involved in the collection of Property Rate Tax as has just been proposed in the 2022 Budget and Economic Policy.

“ChaLoG therefore calls on Parliament not to approve the proposal by Government to collect Property Rate as captured in the Budget Statement and Economic Policy for the 2022 Financial Year.”

COMMENTS