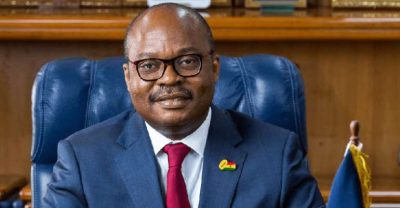

The Governor of the Bank of Ghana, Dr. Ernest Addison, has asked Parliament to allow the law to take its course in the ongoing legal tussle regarding

The Governor of the Bank of Ghana, Dr. Ernest Addison, has asked Parliament to allow the law to take its course in the ongoing legal tussle regarding the revocation of the licenses of some financial institutions.

While the government has commenced criminal proceedings against some shareholders of financial institutions whose licences were revoked, others have also dragged the central bank to court to seek redress.

Parliament is probing circumstances that led to the collapse of uniBank and UT Bank in particular after the lawmaking arm body was petitioned by the two institutions.

According to the Governor, Ernest Addison, running to Parliament to seek redress for the revocation of an institution’s licence is not one of the processes laid down in law.

The BoG Governor said this at the Ghana Chamber of Commerce and Industries’ business forum held on Wednesday, June 23, 2021.

“Running to Parliament to seek redress for the revocation of an institution’s license is not one of the processes laid down under the law for those who feel aggrieved by a license revocation by the Bank of Ghana. There are already a number of actions filed in court and at arbitration by the same persons who run to Parliament for cover-up. And the Bank of Ghana’s simple response to Parliament is to respectfully allow the pending legal processes to run their course.”

“Indeed, sometime in September 2018, the 7th Parliament undertook a formal inquiry into the financial sector clean-up, the key factors that led to it and the manner in which it was carried out. Among other things, we were to appear before it and to answer specific questions aimed at assisting the committee to understand the events surrounding the clean-up exercise. The Bank of Ghana cooperated fully with the committee and provided all the necessary information to assist its members to reach their own conclusions,” he noted.

Dr. Addison explained that the central bank had hoped the committee would have made available its report to Parliament and the public after deliberations, but nothing was heard.

He further asked Ghanaians and Parliament to take a serious view at the GHS19 billion used to settle depositors whose funds had been locked up in the failed banks and SDIs.

“We understand Parliament’s continued interest in the clean-up exercise, especially given the public funds that were used to settle depositors’ claims in order to promote the stability of our financial system. While the legal processes in court and at arbitration run their course, we would respectfully ask that Parliament and indeed all Ghanaians to take a serious view of the GH¢19 billion government had to provide out of taxpayers’ money to settle claims of depositors following the mismanagement and siphoning of several billions of Ghana cedis from the defunct institutions by their shareholders.”

“We all need to lend our support to the Receivers to help retrieve these amounts of money and reallocate them to productive uses to build our economy forward, particularly in the midst of the pandemic.”

COMMENTS